The Municipality of Huron East issues two (2) tax bills annually. Each billing is split into two installment due dates.

The Interim tax bills are mailed the beginning of March containing installments due the last business day of March and the last business day of June.

The Final tax bills are mailed the beginning of September containing installments due the last business day of September and last business day of November.

The due date may fall on a different date based on holidays, so please refer to your bill for the accurate due date.

Note: If you have not received your tax bill or have misplaced your bill, please contact the Municipal Office at 519-527-0160 ext. 22. Failure to receive a tax bill does not excuse the property owner from paying the taxes by the installment date.

On this page:

- How to pay your tax bill

- How to read your property tax bill

- Address change

- Enroll in e-billing

- Late payments

- Returned cheques

- Are you moving?

How to pay your tax bill

The Municipality has a number of options available to our customers for payment. Payment must be received at the Municipal Office by the due date to avoid penalty.

- Pre-Authorized Payment Plan: The amount due for your bill is automatically withdrawn from your bank account upon completion of a Pre-Authorized Payment Plan Application Form. Two pre-authorized options are available; a monthly plan in which a fixed amount is withdrawn from your bank on the first of each month or an installment plan in which the amount due is withdrawn from your bank on the installment due date.

- Telephone/Internet Banking: Most financial institutions offer "The Municipality of Huron East - Taxes" or "Huron East - Taxes" as one of their payees. Payments may be made using your roll number as your tax account number. When using telephone or internet banking, please allow for processing time to ensure your payment is received by the Municipal Office on or before the due date to avoid penalty charges.

- By Mail: Cheques can be mailed with the required payment stub to Municipality of Huron East, PO Box 610, Seaforth, ON N0K 1W0. Allow sufficient time for the payment to reach our office on or before the due date to avoid penalty charges. Please include pay stub with your payment to ensure it is applied correctly.

- In Person: Payments can be made at the Municipal Office, located at 72 Main St. South, Seaforth, Ontario between the hours of 8:30 a.m. - 4:30 p.m., Monday to Friday. Payment methods accepted are cash, cheque and debit. After hours payments can be deposited in our dropbox, located at the Municipal Office.

- Post Dated Cheques: The Municipal Office will accept post-dated cheques corresponding with the amounts and due dates printed on the payment stubs. Please ensure the payment stubs are included with your cheques.

Note: Keep your final tax bill for your records. Please be aware that there is a fee for reprinting your tax bill.

Automated property tax and utility payment processing

Please note that as we transition to a more automated process, please be aware that the system may not identify incorrect account numbers or payments made to the utility account via the taxes account (or vice versa). We understand that mistakes can happen, and our aim is to help you avoid any potential penalties arising from these errors.

General Accounts Receivable payments (i.e., pet tags, rentals, ice fees) are to be paid by e-transfer to payments@huroneast.com with CUST ID. An example would be WATCH0001 (First 5 letters of your last name followed by 4 digits).

Correcting such issues can create extra work for everyone involved. Therefore, we kindly ask that you verify your payments to ensure they are sent to the correct account using the proper account numbers.

For any questions related to property taxes, please contact the Tax Collector at propertytax@huroneast.com

For any questions related to utilities, please contact the Utility Clerk at utilities@huroneast.com.

Updates to Pre‑Authorized Payment Plans (PAP)

The Municipality of Huron East is currently in the process of updating Pre‑Authorized Payment (PAP) amounts for property tax accounts.

Residents who are enrolled in PAP will receive an individualized letter in the mail over the coming weeks. Each letter will include details specific to your property tax account and your updated payment amounts.

Please watch your mailbox for this important correspondence.

As past administrative issues within the Pre‑Authorized Payment (PAP) program are addressed, all participants are required to meet the program’s eligibility criteria, including maintaining a current tax account. Staff are available to provide support; however, it remains the responsibility of each property owner to ensure that taxes are kept paid and up to date.

We appreciate your patience as we work through this update process.

If you have questions about your PAP account, please contact the Property Tax Clerk at propertytax@huroneast.com or 519‑527‑0160 ext. 22.

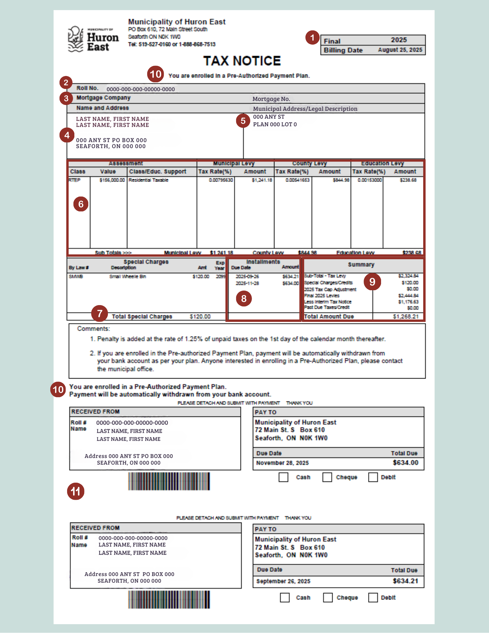

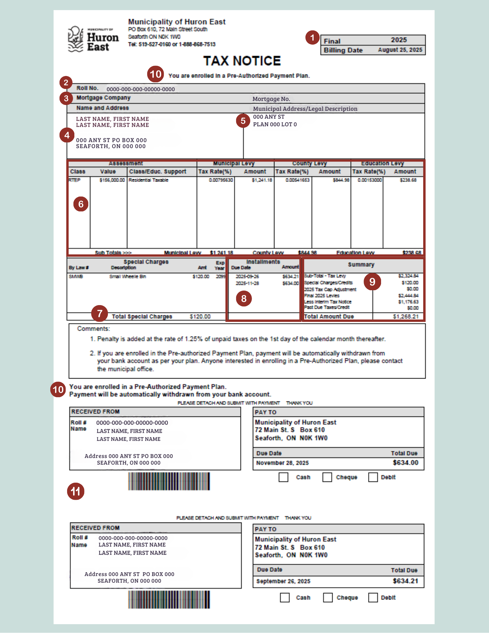

How to read your property tax bill

Legend

The numbers included in the tax bill example photo above correspond with the numbers in the legend below.

- Type of Property tax bill: Interim or Final.

- Roll number: Roll number associated with property. A mortgage company will only be listed if their property taxes are paid by their mortgage company.

- Mortgage company: Name of the Mortgage Company for the billed property

- Address: Address of billed property. Please ensure that the address and mailing are up to date and contact the Municipality for any required changes

- Property description: Address and legal property description

- Municipal tax rate: The tax rate applied to the assessment determines the Municipal Tax Levy amount, funding services like policing, recreational programs, libraries, roads, and sports facilities.

- Special charges: Any additional charges to the tax bill (i.e. wheelie bin, streetlights)

- Installment: All tax bills, whether Interim or Final, require two installment payments. For Interim bills, payments are due on the last business day of March and June, while for Final bills, payments are due on the last business day of September and November. Each installment is 50% of the total tax bill and must be paid on the corresponding due dates listed. Any carryover credit or past due amount is included in the installment payment.

- Total due: This refers to the payment that needs to be made by the installment's due date.

- You are enrolled in the pre-authorized payment plan: This only applies to residents who are signed up for a pre-authorized payment program. This will not appear on your bill, if you are not signed up. To sign up for pre-authorized payments, please fill out the Pre-Authorized Payment Plan Application Form.

Address change

If you need to change or update your mailing address for any reason, please complete the Change of Address Online Form.

Changes to your mailing address need to be made in writing. It's important that we have the most up-to-date mailing information so that you receive your tax, utility and/or invoice on time and avoid late charges.

Failure to receive a tax bill does not exempt you from the payment of taxes, nor penalty and interest.

Enroll in e-billing

To have your tax bill emailed to you, please complete our E-Billing Enrollment Form. If you have any questions or decide to withdraw from E-Send, please contact the Municipal Office at 519-527-0160 ext. 22.

Please note: It is the customer's responsibility to complete a new enrollment form if there is a change to the email address where the tax bill is being sent, and to notify the Municipal Office if your bill has not been received.

Customers using the Tax E-Send service are subject to standard late fees as applicable.

Late payments

A penalty of 1.25% will be added on the first day of default, as well as 1.25% on the first day of each month thereafter.

Penalty is deducted first from all payments made and the balance, if any, will be applied to the oldest outstanding balance first.

Returned cheques

Cheques not honoured by your bank will result in a charge of $35.00 being added to your tax account. Please ensure your cheques are properly completed and signed.

Are you moving?